- Bank Fixed Deposit Rates

- Fixed Deposit Rates In Uk

- Highest Fixed Deposit Rates In Sri Lanka

- High Interest Rate Fixed Deposit

Fixed Deposit Accounts in Singapore

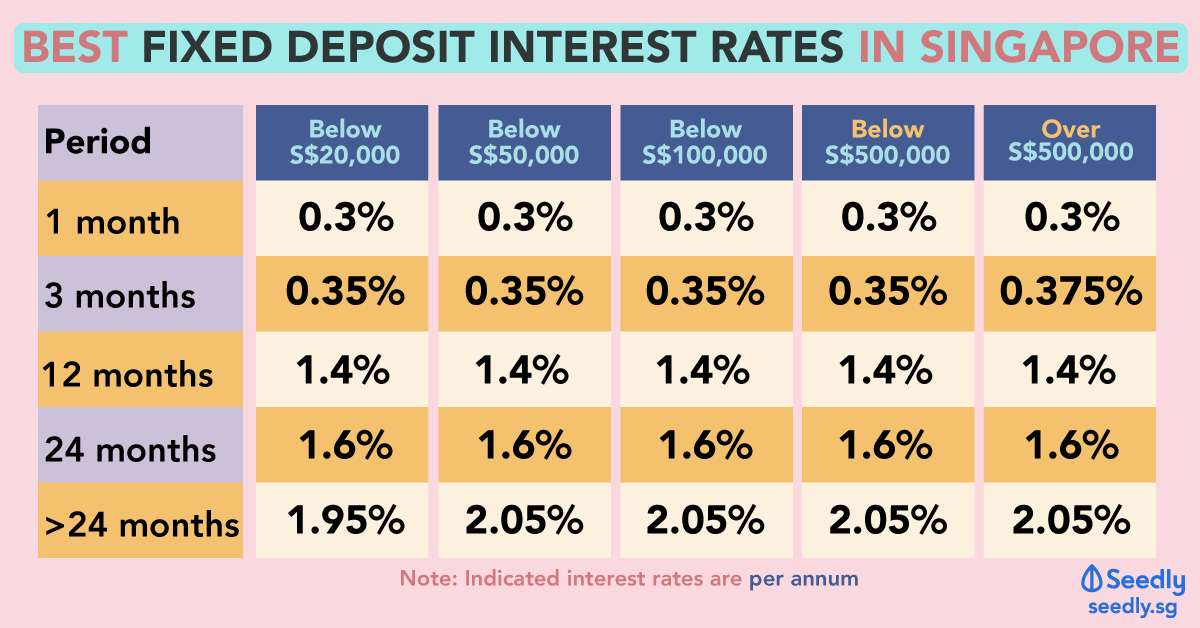

Fixed deposit accounts in Singapore offer a higher interest rate as compared to your basic savings deposit account although the difference has become smaller as fixed deposit interest rates plummeted in recent months. Rates are expected to stay low or even become lower as the economy lay in doldrums due to Covid-19.

Globally deposit rates are products provided and offered by banks to let consumers save for an agreed period time for a fixed interest rate. Constrasting to central bank rates, deposit rates can influence consumers and their investments in other asset classes, while the central bank rates may effect what rates banks may set. Money Compare rounds up the best fixed-rate savings accounts, offering higher interest rates for those prepared to lock up their cash for longer. The interest rate the account reverts to after any introductory bonus rate. Minimum initial deposit. May 11, 2020 Currently, KTDFC, Shriram Transport and Muthoot Capital are offering the highest fixed deposit interest rates (8.00% – 8.09%). However, the DICGC deposit insurance does not cover such corporate deposits. Therefore it becomes important for you, as an investor, to check the credit rating of the company. The current highest DBS fixed deposit rate of 1.3% p.a. Is considered sky-high by today’s standards. The minimum of $1,000 is is quite a manageable amount, although you have to commit to a tenure of 18 months. Otherwise, you can still get a slightly lower interest rate of 1.15% p.a.

Contrary to belief that certain foreign banks might be more risky, the first $75,000 parked in fixed deposits at any bank is risk-free. This is due to the fact that the Singapore Deposit Insurance Corporation (linked to the Singapore government) insures all deposits in any individual bank or finance company operating in Singapore for a sum of up to $75,000.

Consumer banks or finance companies operating in Singapore are also subjected to strict capital requirements well above global standards to protect depositors. Fixed deposits are hence considered very low risk financial products although the returns might be unexciting compared to other investment products.

Tenure and Deposit Amount

As a rule of the thumb, banks or financial companies reward depositors with higher interest for longer tenures and higher deposit amounts. They frequently conduct fixed deposit promotions for certain tenures and deposit amounts to attract fresh funds so as to boast their deposit base. These limited time promotions are usually extremely competitive and might or might not be renewed upon expiry. Sometimes, promotional gifts are offered if certain minimum deposit amount is met.

For a fair comparison of fixed deposit rates (including promotional and non-promotional rates) in Singapore, we have included the comparison table below for reference. The fixed deposit interest rates are based on popular tenures of between 6 to 18 months and fresh funds of $75,000 (Risk-free since insured by SDIC). Rates are based on the assumption of new fresh funds deposit and a depositor doesn't have any privilege or preferred relationship with the bank. We have also include the current Money Lobang Average Fixed Deposit Rates and latest one year returns for Singapore Savings Bonds (Risk-free bonds by Singapore government) so as to facilitate comparison for depositors.

Fixed Deposit Comparison Table

| Financial Institution | Interest Rate |

0.65% | |

0.60% | |

0.60% | |

0.60% | |

0.60% | |

0.52% | |

0.50% | |

0.50% | |

0.50% | |

0.46% | |

0.45% | |

0.45% | |

0.40% | |

0.40% | |

0.40% | |

0.35% | |

0.32% | |

0.21% | |

0.10% |

* Interest Rate based on maximum deposit amount of $75,000 and tenures ranging from 3 to 18 months

Best Highest Fixed Deposit Interest Rates in

Singapore

The highest interest rate is by Sing Investments and Finance which offers an interest rate of 0.65% p.a. for 18 months tenure and funds of $10,000 and above. This is followed by another offer by Bank of China which offers an interest rate of 0.60% p.a. and tenure of 12 months for funds of $20,000 and above. The highest rate is 0.19% or about 41% higher than Money Lobang's National Average Fixed Deposit Rates for March 2021 is 0.46% p.a.

Smart Search for Fixed Deposit Account

Still unable to find the fixed deposit account due to a different tenure or deposit amount? Feel free to use our Smart Search which will narrow your choices down to a list of deposit accounts that are most suitable for you according to your deposit amount and preferred tenure.

This Fixed Deposit Interest Rate table shows the best interest rate currently on offer by the 27 commercial banks in Nepal. The interest rates are updated on a monthly basis.

Last updated: 16 December 2020

What’s a fixed deposit?

A fixed deposit is one of the safest and risk-free investment that you can make.

You place your funds for a set period of time of your choosing with a guaranteed interest rate paid at the end of the fixed term.

Fixed deposits also give you a higher interest rate than a traditional savings account.

Are fixed deposits a safe investment?

Bank Fixed Deposit Rates

Yes, they’re generally considered to be one of the safest investment you can make.

Fixed Deposit Rates In Uk

This is because up to Rs 300,000 held in a fixed deposit account with commercial banks in Nepal is guaranteed by the Deposit and Credit Guarantee Fund.

So even if the bank itself fails, this government fund will pay its depositors up to that limit.

How is interest calculated with a fixed deposit account?

The interest on fixed deposit accounts is calculated daily and added quarterly (capitalised) to your deposit.

Some banks also provide you with an option for the accumulated interest to be transferred quarterly or at maturity.

How to calculate interest in fixed deposits?

Please use our Fixed Deposit Interest Calculator to work out how much interest you’ll earn by the end of the maturity period.

Fixed Deposit Calculator

Can I withdraw money from a fixed deposit?

Not all banks allow you to withdraw money from a fixed deposit acccount.

Circumstances change, so you may require your money sooner than expected. Some banks may allow you to withdraw your money but they’ll usually charge you an early withdrawal penalty fee.

One option will be to take out a loan against the fixed deposit, but this is not recommended.

Therefore, before you put your money in a fixed account:

- Create a separate emergency savings account with enough funds to cover six month of your living expenses.

- Opt for a shorter loan term. You don’t necessarily have to go for the longest term.

What is a recurring fixed deposit?

A recurring fixed deposit is an account where you regularly deposit a pre-determined amount instead of a lump-sum like in a regular fixed deposit account.

It is ideal for salaried employees and professionals who earn a regular income. It is a great way to build a savings habit and increase your long term savings.

Highest Fixed Deposit Rates In Sri Lanka

Another thing that makes recurring deposit account great is that a few banks will allow you to withdraw money without penalties if you have already completed half of the fixed term.

Do you have any tips on fixed deposit?

High Interest Rate Fixed Deposit

Feel free to leave your thoughts or comments below.